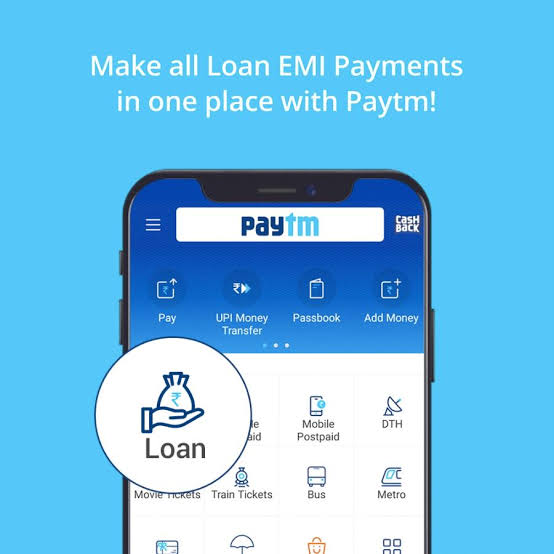

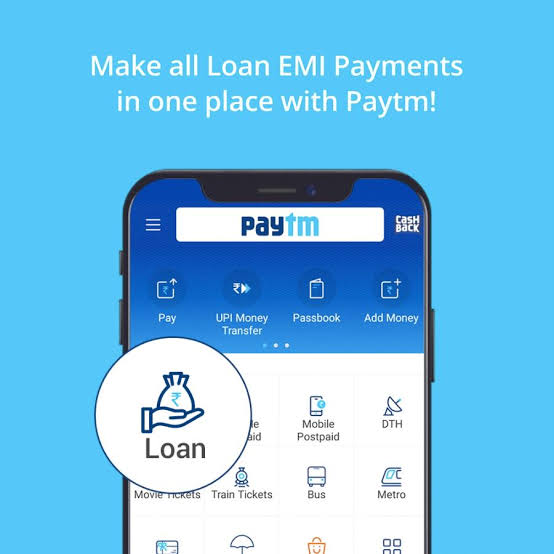

With the launch of Postpaid Mini, the company will offer loans ranging from Rs 250 to Rs 1000, in addition to a quick loan of up to Rs 60,000. This loan will help users pay their monthly bills such as mobile and DTH withdrawals, booking a gas cylinder, electricity and water.

New Delhi. If you are a Paytm user there is good news for you. Now a loan of up to 60 thousand rupees will be available on Paytm in a few minutes. Paytm has launched Postpaid Mini, expanding its Buy Now, Pay service later. With this, the company will provide a small loan. The company has partnered with Aditya Birla Finance Limited on this. The company said borrowing small tickets will give customers flexibility and control house costs to keep cash during the coronavirus epidemic.

With the launch of Postpaid Mini, the company will offer loans ranging from Rs 250 to Rs 1000 without immediate loan up to Rs 60,000. This loan will help users pay their monthly bills such as mobile and DTH withdrawals, booking a gas cylinder, electricity and water. Also, customers can shop at Paytm Mall with Paytm Postpaid Mini.

New credit bureau for the first time

Bhavesh Gupta, CEO, Paytm Lending said we are launching a new lending center for the first time. In this case, financial discipline will be imposed on them. Through this late payment center, we are making a concerted effort to increase economic expenditure. With our new back payment service, users will be able to pay their bills and bills on time.

No interest will be charged within 30 days

Paytm offers up to 30 days to repay the loan at zero percent interest on the service already paid. There is no annual fee or start-up for this. However, there will be only simple payments. With Paytm Postpaid, users can pay at online retailer and offline stores nationwide without having to worry about losing their monthly budget. Paytm Postpaid is available in more than 550 cities across the country.